Reporting

Reporting

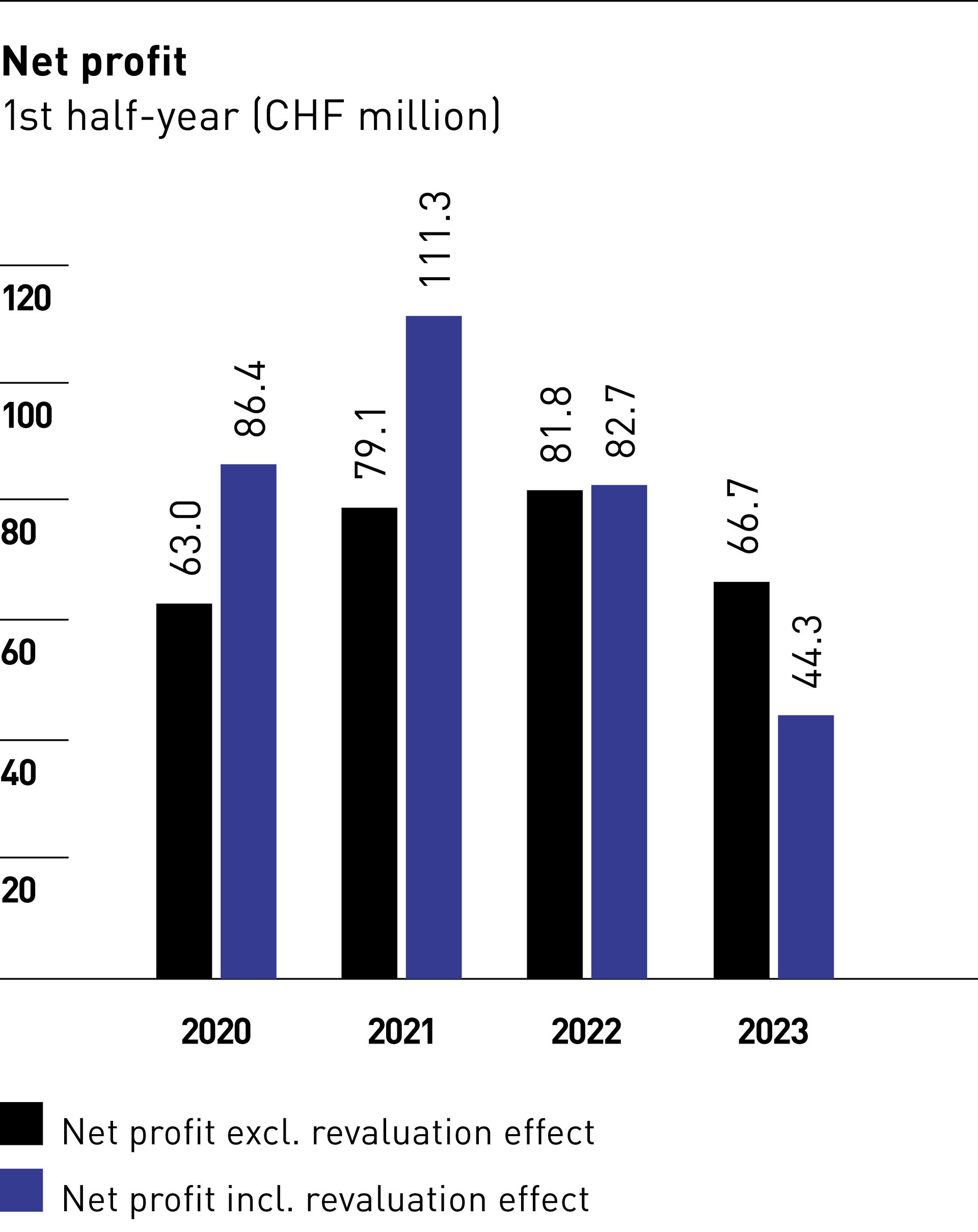

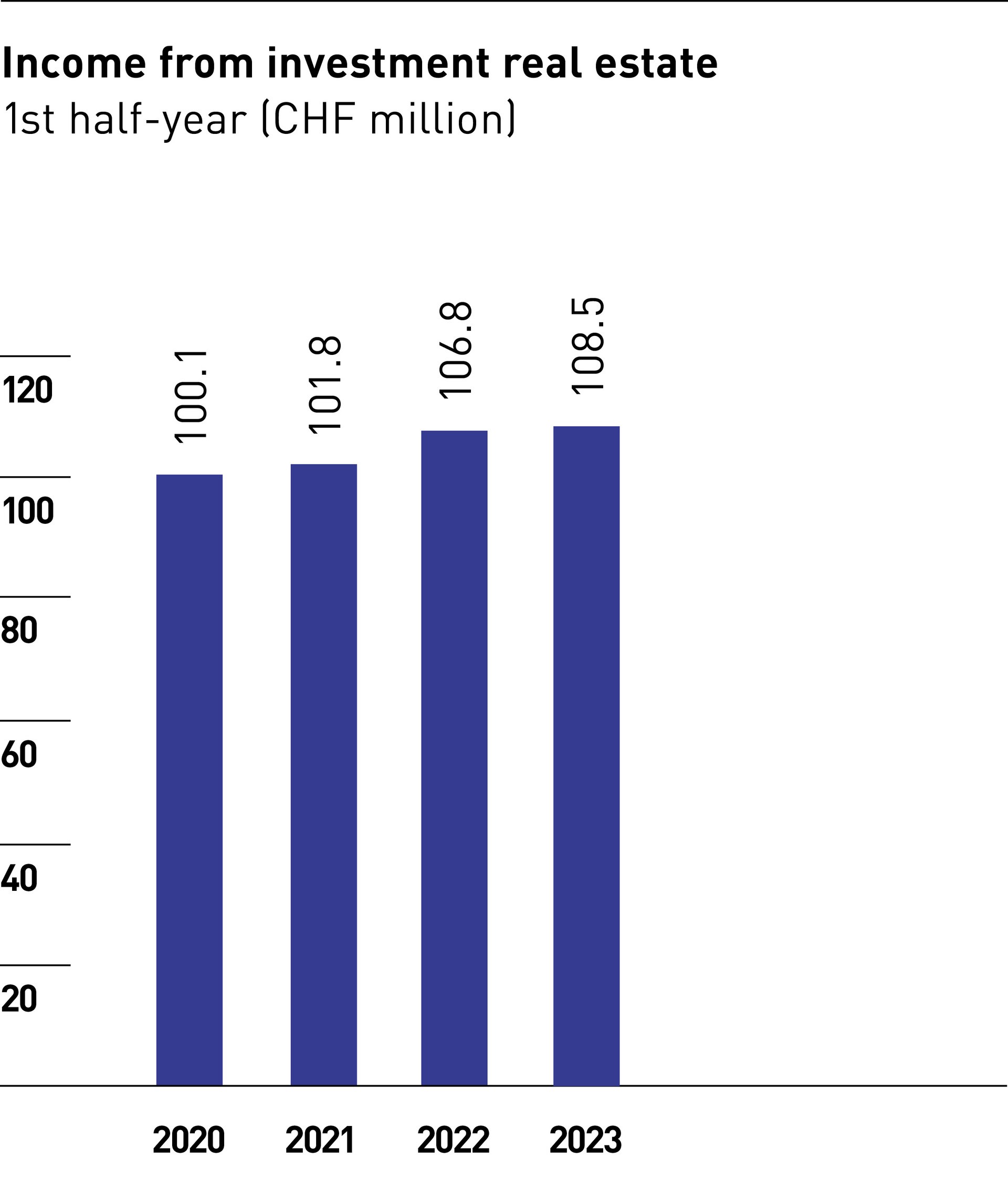

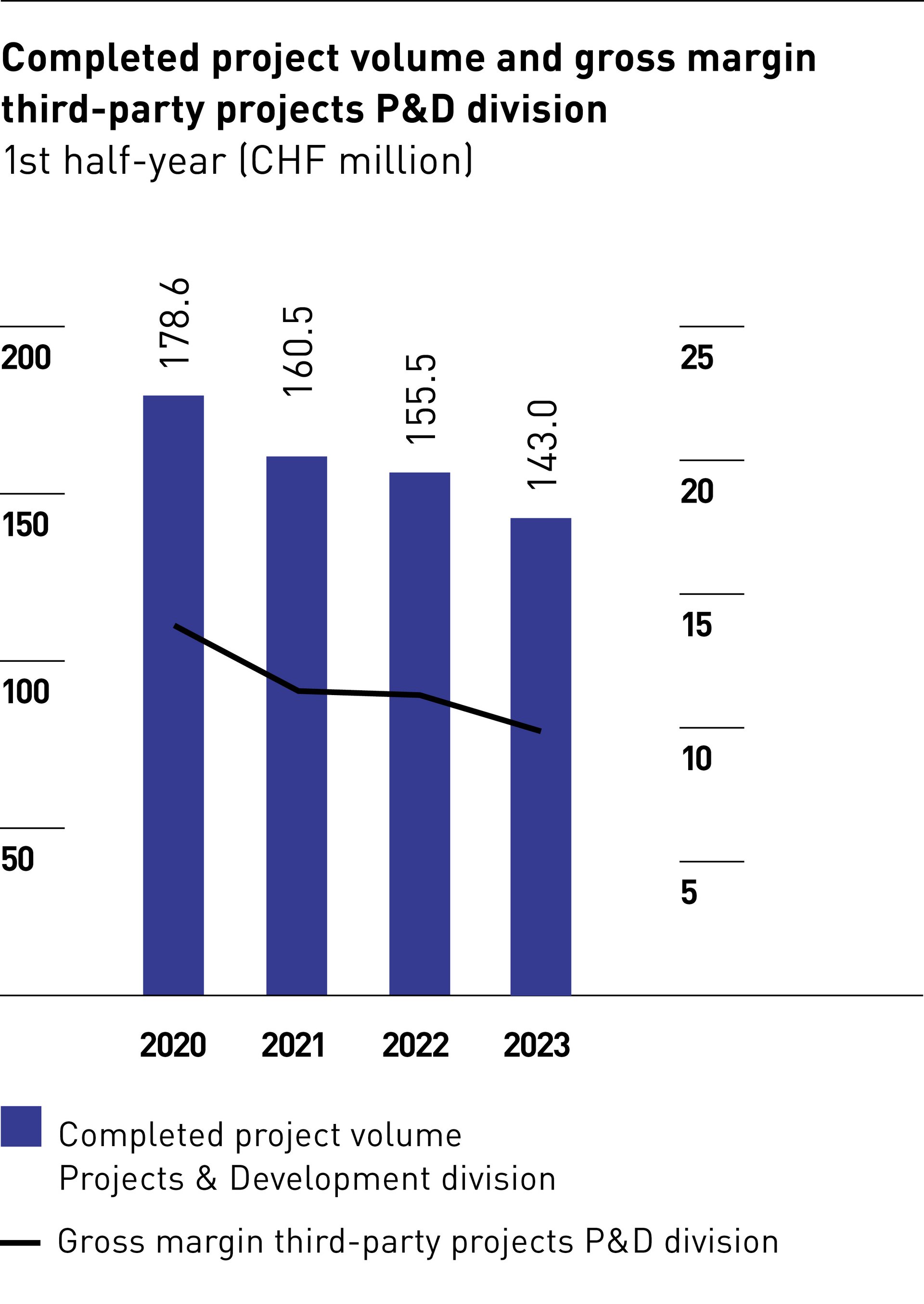

Allreal’s net profit excl. revaluation effect fell year on year in the first half of 2023. This can primarily be attributed to the lower income from the sale of development real estate, as well as the higher net financial expense. Rental income in the Real Estate division increased, while vacancy rates remained very low. Earnings from the Projects & Development division were significantly down on the previous year. The reason for this – besides the challenging economic environment in general – is essentially that sales of condominiums are cyclical. The most important figures and developments are shown below.

1st half-year 2023 | 1st half-year 2022 | Change | ||||||

Group | ||||||||

Total sales2 | CHF million | 251.5 | 262.3 | –4.1 | ||||

| Operating profit (EBIT) incl. revaluation gains | CHF million | 69.0 | 101.8 | –32.2 | ||||

Net profit incl. revaluation effect3 | CHF million | 44.3 | 82.7 | –46.4 | ||||

| Operating profit (EBIT) excl. revaluation gains | CHF million | 95.1 | 100.7 | –5.6 | ||||

Net profit excl. revaluation effect3 | CHF million | 66.7 | 81.8 | –18.5 | ||||

| Cash flow | CHF million | 27.6 | 73.9 | –62.7 | ||||

Return on equity incl. revaluation effect3 | % | 3.5 | 6.5 | –3.0 | ||||

Return on equity excl. revaluation effect3 | % | 6.3 | 7.8 | –1.5 | ||||

| Equity ratio on cut-off date | % | 44.3 | 45.6 | –1.3 | ||||

| Net Gearing4 on cut-off date | % | 106.0 | 99.9 | 6.1 | ||||

| Net finance debt5 | CHF million | 2 676.5 | 2 594.6 | 3.2 | ||||

| Average interest rate on financial liabilities on cut-off date | % | 1.27 | 0.86 | 0.41 | ||||

| Average duration of financial liability on cut-off date | months | 41 | 37 | 4 | ||||

| Sales Projects & Development division | CHF million | 143.0 | 155.5 | –8.0 | ||||

Earnings from Projects & Development division6 | CHF million | 17.6 | 34.9 | –49.6 | ||||

Gross margin third-party projects Projects & Development division7 | % | 9.9 | 11.2 | –1.3 | ||||

| Employees on cut-off date | full-time equivalents | 227 | 227 | 0 | ||||

| Share | ||||||||

Earnings per share incl. revaluation effect3 | CHF | 2.68 | 5.01 | –46.5 | ||||

Earnings per share excl. revaluation effect3 | CHF | 4.04 | 4.95 | –18.4 | ||||

| Net asset value (NAV) per share before deferred tax on cut-off date | CHF | 175.58 | 179.75 | –2.3 | ||||

| Net asset value (NAV) per share after deferred tax on cut-off date | CHF | 152.89 | 157.20 | –2.7 | ||||

| Share price on cut-off date | CHF | 151.20 | 150.40 | 0.5 | ||||

| Valuation on cut-off date | ||||||||

Market capitalisation8 | CHF million | 2 496.3 | 2 483.7 | 0.5 | ||||

Enterprise value9 | CHF million | 5 172.8 | 5 078.3 | 1.9 |

*Should no further particulars be given, values referring to the income statement concern the first half-year, and balance sheet values the cut-off dates 30 June 2023 and 31 December 2022.

1Changes in number and percentage values are shown as an absolute difference

2Income from rental of investment real estate plus completed project volume in the Projects & Development division

3Revaluation gains refer to gains from the revaluation of investment real estate less deferred taxes on revaluation

4Borrowings minus cash and marketable securities as a percentage of equity

5Borrowings minus cash and marketable securities

6Income from realisation Projects & Development, sales Development, capitalised company-produced assets and various revenues minus direct expenses from realisation Projects & Development and sales Development

7Earnings from realisation Projects & Development as a percentage of income from realisation Projects & Development

8Share price at balance sheet date multiplied by the number of outstanding shares

9Market capitalisation plus net finance debts

1st half-year 2023 | 1st half-year 2022 | Change | ||||||

| Yield-producing properties | ||||||||

| Residential real estate on cut-off date2 | number | 38 | 37 | 1 | ||||

| Commercial real estate on cut-off date3 | number | 40 | 42 | –2 | ||||

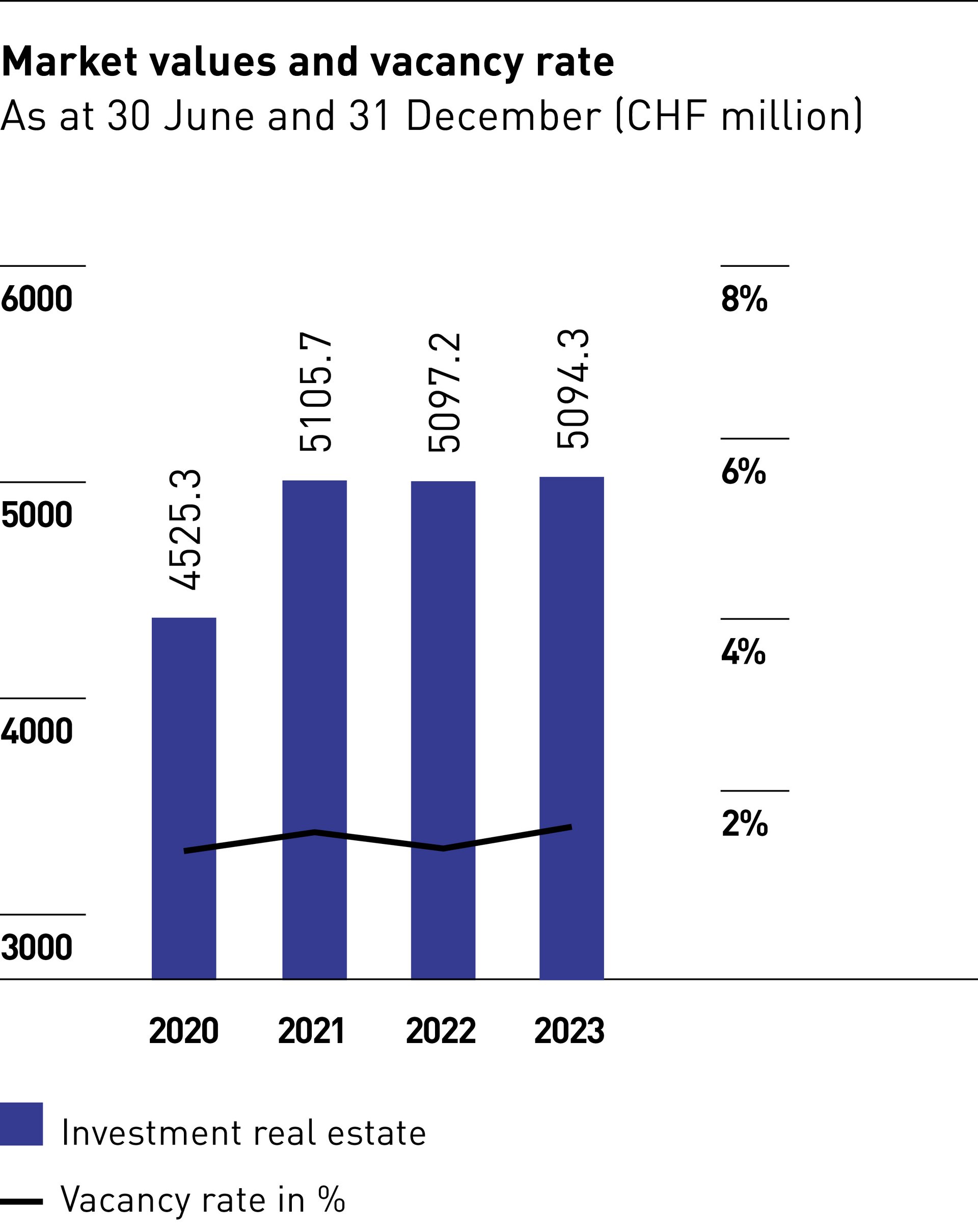

| Market value on cut-off date | CHF million | 4 890.4 | 4 917.6 | –0.6 | ||||

| Rental income from investment real estate | CHF million | 108.5 | 106.8 | 1.6 | ||||

| Vacancy rate4 | % | 1.7 | 1.5 | 0.2 | ||||

| Real estate expenses | CHF million | –10.5 | –10.8 | –2.8 | ||||

| Real estate expenses | in % of | 9.7 | 10.1 | –0.4 | ||||

| Gross yield5 | % | 4.4 | 4.3 | 0.1 | ||||

| Net yield6 | % | 4.0 | 3.9 | 0.1 | ||||

| Investment real estate under construction | ||||||||

| Buildings on cut-off date | number | 4 | 3 | 1 | ||||

| Market value on cut-off date | CHF million | 203.9 | 179.6 | 13.5 | ||||

| Investment volume | CHF million | 227.5 | 195.6 | 0.3 | ||||

| Development real estate | ||||||||

| Book value development reserves on cut-off date | CHF million | 335.2 | 381.0 | –12.0 | ||||

| Estimated investment volume development reserves | CHF million | 812.3 | 915.5 | –11.3 | ||||

| Book value buildings under construction on cut-off date | CHF million | 65.7 | 37.2 | 76.6 | ||||

| Estimated investment volume buildings under construction | CHF million | 114.7 | 48.4 | 120.2 | ||||

| Book value completed real estate on cut-off date | CHF million | 0.0 | 0.0 | 0.0 |

*Should no further particulars be given, values referring to the income statement concern the first half-year, and balance sheet values the cut-off dates 30 June 2023 and 31 December 2022.

1Changes in number and percentage values are shown as an absolute difference

2The change includes the addition of the property Avenue du Cimetière 22 in Petit-Lancy GE as of 1 April 2023.

3The change includes the consolidation of the properties of the Dreieckareal in Winterthur ZH, which were previously managed as individual properties, and the sale of the property In der Luberzen 29 in Urdorf ZH as of 30 June 2023.

4As a percentage of target rental income, cumulative as at cut-off date

5Rental income from investment real estate as a percentage of continued market value of yield-producing properties as at 1 January

6Rental earnings from investment real estate as a percentage of continued market value of yield-producing properties as at 1 January